Investing for Cash Flow

Most millionaires share a common strategy, and it’s no secret – they focus on building multiple streams of income. 65% of millionaires have at least three income streams, and nearly a third of millionaires have five or more income streams. Generating regular consistent cash flow is the single best way to build wealth. Investing for […]

Upside Avenue Adds 737 Units to REIT Portfolio

Upside Avenue has announced the addition of 737 new multifamily units to its REIT portfolio in Houston, Texas. The Quinn at Westchase is located in one of Houston’s most prominent neighborhoods, the Westchase district. Located west of uptown and just south of the energy corridor, the neighborhood has great access to many of the city’s […]

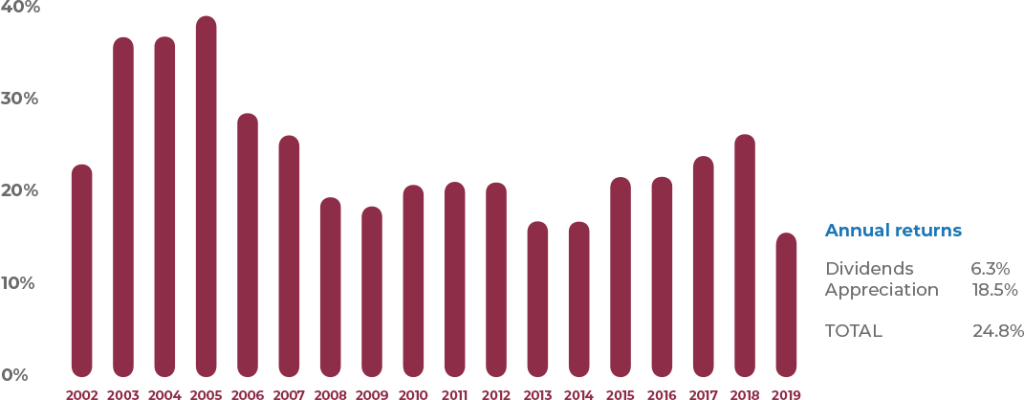

REITs offer both dividends and appreciation – what’s the difference?

Dividends and appreciation investment are two different forms of earnings on an investment. There can be a good deal of crossover between the two, and REITs offer a particularly unique advantage as an investment vehicle that provides returns in the form of both dividends and appreciation. What is a dividend? In real estate investing, dividends […]

COVID-19: Our Commitment To Our Investors

As the Coronavirus (COVID-19) outbreak creates uncertainty in the economy and among global populations, our commitment is to keep you informed on the health of your investment with us. Upside Avenue is in a strong position to weather a recession – we’ve added eight properties to our portfolio in the past year and averaged a 5.73% annualized […]

Upside Avenue Adds 1,070 Units to REIT Portfolio

Upside Avenue REIT Announces 7% Annualized Dividend

We are passionate about multifamily real estate, and it shows. Thanks to our experienced team of experts, Upside Avenue has grown its portfolio of high-quality multifamily properties in Texas. The result is strong quarterly returns for our investors. Upside Avenue issued a 7% annualized dividend, gross of fees, to shareholders on record as of the […]

Upside Avenue adds two properties to its REIT portfolio

Why invest in a non-traded REIT?

Non-traded REITs offer certain buffers against stock market volatility By Thomas Parker With fears over a new recession, investors are looking for ways to stabilize their portfolios ahead of a downturn. More and more investors are allocating funds into income-producing real estate that isn’t correlated to stock market volatility. According to investment banking firm […]

What do Cap Rates tell you about a real estate investment property?

You can discover a property’s cap rate in a single simple formula. Upside Avenue CIO Todd Marney shares what a Cap Rate is, how it can help you make smart investment decisions, and helps you understand the different cap rates for different types of real estate. By B. Todd Marney If you’re new to […]

How the yield curve helps you plan for a recession

Is a recession imminent? Upside Avenue CEO Yuen Yung shares how understanding the U.S. Treasury yield curve can help you make sure your portfolio is ready for a downturn You’ve heard all of the tensions economists and analysts have over the inverted yield curve, but does that mean for your investments? In this post, […]