Funding with Retirement Accounts

Use Your Self Directed IRA for Real Estate Investments

Boost the investment power of your retirement portfolio

Discover the benefits of commercial real estate cash flow and appreciation without the headaches of sourcing, acquiring, and managing properties yourself.

Adding the non-traded multifamily REIT from Upside Avenue to your retirement portfolio can generate long-term growth and passive income. Use your self-directed retirement account to buy real estate investment trust shares.

Ideal for self-directed 401k’s or SEP’s, and after-tax retirement accounts such as Roth IRA’s, the Upside Avenue REIT can provide you with stability outside of the stock market and passive income for retirement.

UPGRADE YOUR RETIREMENT PLANS

BUY UPSIDE AVENUE’S MULTI-HOUSING INCOME REIT SHARES WITH YOUR SELF-DIRECTED IRA

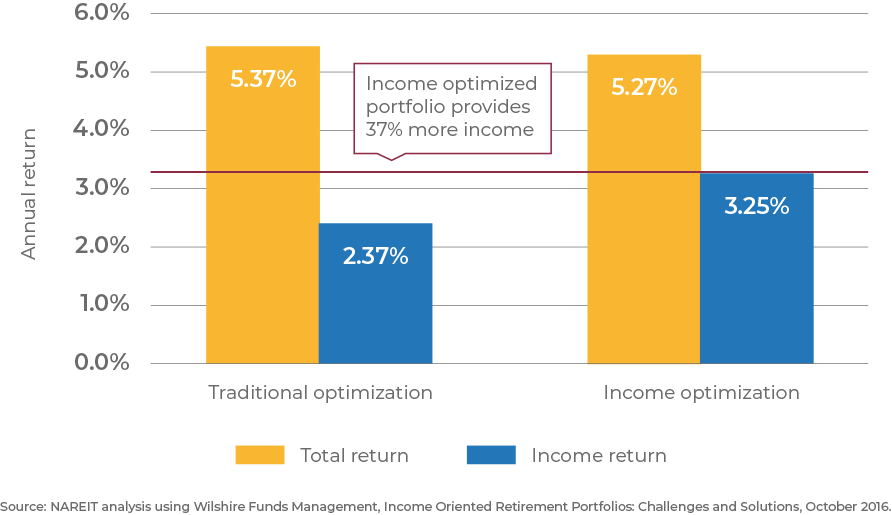

Portfolios optimized for providing cash flow (and adding a REIT) produced nearly 40% more income than a traditional portfolio.

Upside Avenue currently works with many retirement account custodians

Search for your retirement custodian

Don’t see your SDIRA custodian? In most cases, we can get them added quickly and easily. Provide your contact information below as well as the company name of your after-tax retirement account and we’ll work to add them to our list of accredited custodians and notify you when the process is complete.

Adding the Upside Avenue multifamily REIT can generate meaningful benefits for your retirement outlook.

” REITs are excellent candidates for retirement account investments. The tax-advantaged nature of retirement accounts can magnify the already tax-advantaged nature of REITs, which can result in some powerful long-term return potential. ” — Motley Fool

” Few asset classes are better suited to retirement portfolios than real estate. If managed sensibly, a portfolio of real estate investment trusts (REITs) can provide a steady stream of retirement income that will last a lifetime. ” — KIPLINGER

Improve Your Retirement Upside

Add our Multi-Housing Income REIT to your self-directed retirement account today.