You can discover a property’s cap rate in a single simple formula. Upside Avenue CIO Todd Marney shares what a Cap Rate is, how it can help you make smart investment decisions, and helps you understand the different cap rates for different types of real estate.

By B. Todd Marney

If you’re new to real estate investing, one of the key phrases you’ll run into time and again is “cap rate.” A cap rate is a simple calculation that you can do to find key information on a property before you decide whether to invest. In this article, I’ll walk you through how to figure out a cap rate for an investment property, talk about what factors can affect an investment property’s cap rate, and show the types of cap rates for different kinds of real estate investments.

What is a Cap Rate?

“Cap rate” is short for capitalization rate, and it means the expected return that you can expect to generate on a real estate investment property. If you want to get the best predictor for what kind of earnings you can get from an investment property, then you need determine the property’s cap rate.

How do I calculate the Cap Rate?

The formula for a cap rate is as follows:

NOI / Purchase Price = Cap Rate

The NOI, or Net Operating Income, includes all revenues minus all operating expenses. Let’s break it down further:

Say you have a property that generates $12,000 a year in rental income. It costs roughly $3,500 a year in management fees, maintanence costs, taxes and insurance. Your NOI is $8,500, which is the actual cash the property generates.

The purchase price is what you pay for the property, including debt and equity. Let’s say in this example, you purchased the rental property for $100,000.

Divide the NOI by the purchase price, and you get the cap rate:

$8,500 / $100,000 = 0.085 or 8.5% cap rate.

Which is better – a lower or higher cap rate?

The basic answer is: It depends. Are you looking for a sure thing that’s definitely going to produce a return? A brand-new property with that’s fully-leased out on a 50-yard-line location is going to have a lower cap rate. You’ll also expect a lower, yet steady return.

Those are the kinds of properties that big pension funds like because they’re low risk – they know they’re going to get a coupon-clipper. The cap rate on that deal may be 4-4.5% So, that’s telling you it’s a 4-4.5% property-level return on that purchase price.

On the other end of the spectrum, you have older properties in less-desirable locations. They cost less to acquire but may require some capital to build it up. The cap rate for this kind of property is going to be higher, maybe a 7% or 8% cap rate. These properties carry higher risk and they have higher cap rates. It’s less of a sure thing, but if it performs, your returns are going to be higher.

Upside Avenue invests in properties that tend to be at a 5-6% cap rate. We invest in value-add properties that demonstrate, after a solid due diligence process, that they are likely to provide strong returns over time.

Can the cap rate of my investment property change over time?

Say you buy a property that has an initial cap rate of 5%. if rents are increasing, your cap rate after one year of the hold period is going to be higher. This happens because your NOI has gone up, but the amount of money you have in the deal remains static. So, the cap rate on your investment property should rise over the life of the hold period, all else remaining equal.

Assessing the Cap Rate

When you find a potential investment property, you’ll need to consider several factors that can impact that property’s cap rate.

Location

The better the location of your investment property, generally the lower the cap rate. Location factors include the property’s visibility, its curb appeal, the ease of access (entry, exit and parking), and – for residential properties – access to jobs, commute times, and proximity to entertainment. All of these factors will affect your potential investment property’s cap rate.

Interest Rate Environment

Generally speaking, a cheaper debt market will keep cap rates low. For example, when you’re buying a house, you can afford more house when the interest rate is 4% on your mortgage then when the interest rate is 10% on your mortgage. Your payments are going to be lower overall. If you translate that to an investment property, that payment affects what you’re able to earn from the property and put it into your own pocket.

So, a low interest rate environment promotes low cap rates. As interest rates move up, cap rates will move up as well, because you have a required rate of return for your equity investment.

What happens when the Fed messes with the interest rate?

When the fed starts raising interest rates is when you start getting a little bit more nervous, at least on new acquisitions. This is because you have to build the interest rate changes into your analysis and what you’re willing to pay for a property. You’re generally borrowing 70-80% from the bank. If that interest rate goes up 100 basis points, that affects what you’re willing to pay for that property.

So, if you feel like interest rates are going to go up, especially in the short term, then you want to lock in long-term fixed-rate debt. If you feel like the interest rate environment is going to improve and rates are going to go lower, you may want to opt for a variable rate loan.

Asset Type

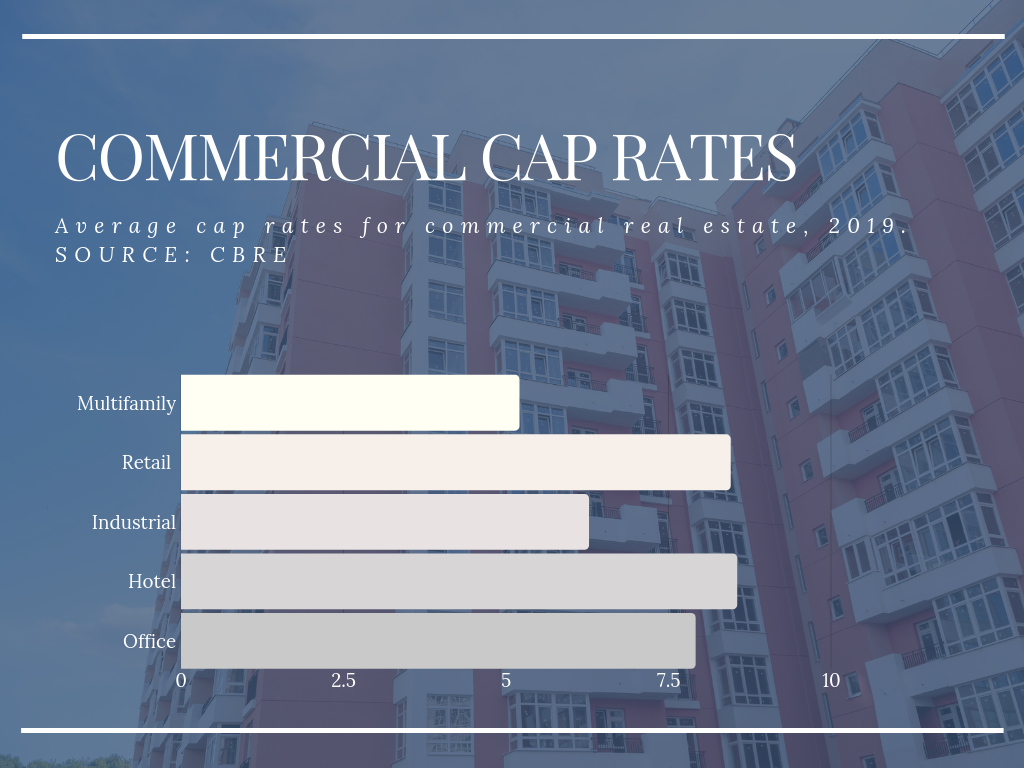

Cap rates vary quite a bit across the asset type. You can see the variations of cap rates for commercial real estate:

Multifamily is typically the lowest cap rate of all commercial real estate. Let’s dig a little deeper to see why that is the case.

Risk Profile

Of all of these asset types, multifamily has the lowest risk profile. Let’s take the extreme – an industrial property like a warehouse that’s 100,000 square feet. Let’s say there are three tenants in the warehouse. If you lose one of those tenants, you have a 33% vacancy.

On the other hand, if you lose one lease in a multifamily property, especially in a larger property with 200+ units, it really doesn’t materially affect your income. That’s a 0.5% vacancy. You can see that it’s less volatile.

The same is true about office buildings. Our office is headquartered in a building with maybe 20 tenants at the most. For offices, if they lose a tenant – especially an anchor tenant – they’ve got a big hole to fill.

Another thing with office space is the emergence of being able to work from home. The days of private offices are really gone. You see more shared space, more high-density, cubicle-type space. So the demand for office space is less than what you would have had 20 years ago. It’s cheaper for businesses to have people working out in the field because we’re not paying to lease as much space.

With all commercial real estate asset classes, aside from multifamily, you incur major costs when you have a tenant move out. It’s very expensive to re-tenant that space because there are tenant improvement costs. You need to reconfigure the space to fit the new tenant’s needs.

In multifamily, however, when we have a resident leave, we come in and touch up paint, we clean the carpet and do other relatively minor repairs or updates, and we’re ready to go. So that’s why the multifamily risk is so much lower, and it’s reflected in the cap rates.

Summary

Determining a property’s cap rate is a simple formula: NOI/Purchase Price = cap rate. The cap rate tells you what kind of returns you can expect to get on your investment, bearing in mind that the higher the cap rate, the more risk is involved. It’s up to you to decide your own risk tolerance and make decisions from there as to the location, age, and type of property you want to invest in.

If you’d like to start investing in commercial real estate without the hassle of acting as the owner/landlord, you’ll want to check out the Upside Avenue REIT. With Upside Avenue, you can have the same access to premium multifamily real estate investing as the uber-wealthy for a minimum investment of only $2,000.

About B. Todd Marney

Todd Marney serves as Chief Investment Officer at Casoro Group and its wholly-owned subsidiary, Upside Avenue. Casorogrew out of a time-tested, vertically integrated, real estate-focused family enterprise, which has acquired, managed and repositioned more than $1.5 billion in properties since 2003.

Todd possesses more than 30 years of national-scope residential and commercial real estate experience in both acquisitions and asset management. He has operated in similar roles at KC Venture Group and McCann Realty Partners in Dallas, Texas. Prior to that, Todd was senior vice president of acquisitions and asset management for Eliason Real Estate Group. There, he successfully established platforms which supported the purchase and management of over 5,000 multi-housing units across the Sunbelt and Midwest.