Non-traded REITs offer certain buffers against stock market volatility

With fears over a new recession, investors are looking for ways to stabilize their portfolios ahead of a downturn. More and more investors are allocating funds into income-producing real estate that isn’t correlated to stock market volatility.

According to investment banking firm Robert A. Stanger & Co., sales of shares in non-traded REITs totaled nearly $1.4 billion in August, a six-year high.

So, why are investors scrambling for nontraded REITs? And what is a nontraded REIT anyway?

What is a non-traded REIT?

A REIT is a type of investment vehicle that crowdfunds capital from a group of investors to acquire real estate assets that are professionally managed, earn income from increased rents and property appreciation, and—by law—pay out 90% of their taxable income to investors. Investors purchase shares of a fund and do not own the real estate outright. Another key feature of REITs are distributions paid out directly to investors, which offers an income stream.

Real Estate has historically been illiquid. Meaning, once you have ownership of an asset it is hard to sell your stake in that asset. With REITs, you get immediate liquidity. You can buy and sell shares daily.

A public, non-traded REIT is regulated with the Securities and Exchange Commission, which means its performance reporting is available to the public. However, its shares are not traded on a national stock exchange. Because of this, the value of each share is correlated to the underlying real estate in the REIT’s portfolio. This offers protection against stock market volatility or daily fluctuations in the price of shares. Non-traded REIT share prices often remain stable and predictable for longer periods, which allows investors and REIT managers to take a long-term approach to decision-making without pressure from sudden fluctuations in value.

Why invest in a non-traded REIT?

Investing in a non-traded REIT is an attractive option for investors who want the recession hedge that high-quality, in-demand real estate – like multifamily – can offer.

Benefits:

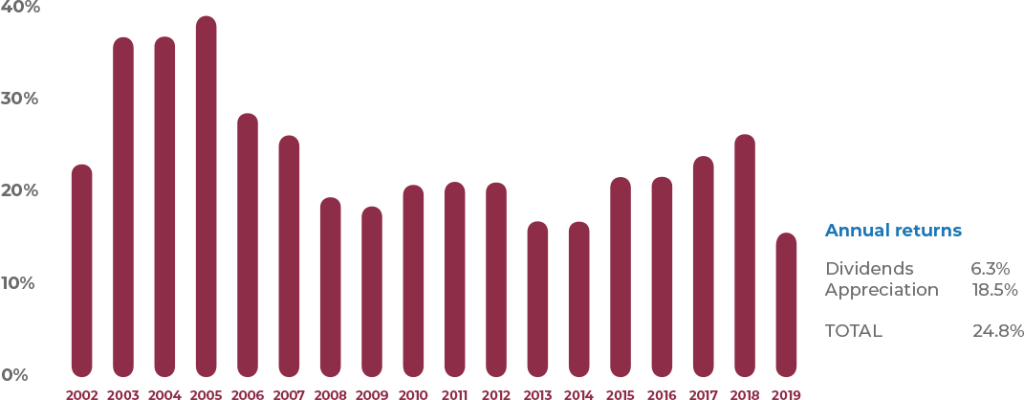

Attractive yields and dividends. Because REITs are required to pay out at least 90 percent of their earnings in the form of dividends, they avoid taxation at the corporate level. This means they can pass on a greater portion of earnings to shareholders. Investors then get payments from the REIT, which they can use to reinvest back into the REIT to purchase additional shares, or they can take them out as income.

Diversification. Real estate is considered a low-correlation asset class, meaning the behavior of the stock market rarely affects how real estate will perform. Each Real Estate asset stands alone as its own investment. The pricing and information on the said asset are often subject to the projection by the Real Estate companies buying or selling the asset. So, when the stock market goes down, real estate is not directly affected.

Potential hedge against inflation. Real estate can provide long-term capital appreciation when the assets sell. Couple that with yearly rent increases designed to keep pace with rising inflation, and non-traded REITs offer an attractive protection against inflation.

Access to high-quality, professionally-managed real estate. Nonaccredited investors (the majority of people) can get the same access to large, high-quality real estate portfolios as the uber-wealthy for a fraction of the price. For example, Upside Avenue gives investors the ability to buy shares in a growing portfolio of high-performing multifamily properties for a minimum investment of $2,000. Couple this access with the professional property management and leasing capabilities of REITs and you have a truly passive form of income-generating, recession-proof investing.

What about the 2008-09 downturn?

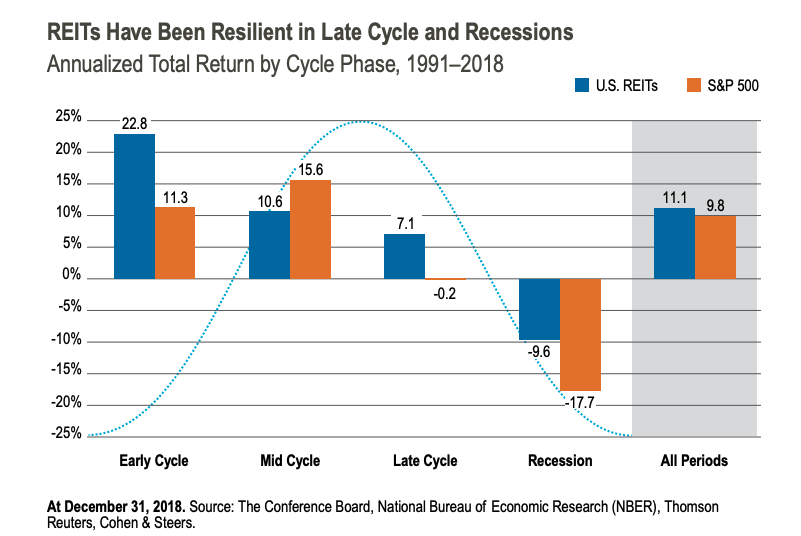

Investors see the real estate crash of the last great recession and may pause at the idea of using real estate as a hedge against a future recession. The reality is, each recession is unique, and REITs have fared much better than regular stocks during most recessions.

A recent study by Cohen and Steers showed that “REITs outperformed the S&P 500 by more than 7% annually in late-cycle periods since 1991 and offered meaningful downside protection in recessions.”

Why invest in multifamily REITs?

Apartments are becoming the No. 1 choice of housing for the largest generational cohorts, Baby Boomers and Millennials. For a variety of reasons, more and more people are eschewing expensive-to-purchase-and-maintain houses for the flexibility, lower cost, access to desirable amenities, and ease of maintenance provided by multifamily community life. We call this flexibility of living the “new American Dream.”

Additionally, out of all of the commercial REIT asset classes, multifamily has the lowest risk profile. Apartment communities, student housing, and senior living communities spread out the cost that tenant vacancies incur, compared with that of office or industrial REITs. If a multifamily community with 200 units loses a tenant, it’s a 0.5% vacancy rate. Compare that with an industrial facility, which may have three tenants maximum. If that facility loses a single tenant, it experiences a 33% vacancy rate.

Summary

Non-traded REITs provide a buffer against stock market uncertainty and have historically outperformed the stock market during economic downturns. For investors looking seeking out income-producing assets that are low-maintenance and not correlated to the stock market, multifamily REITs make an attractive choice.

About Thomas Parker

Thomas Parker leads Investor Relations for Upside Avenue. He ensures a smooth onboarding process for new clients into the REIT platform and assists those using self-directed IRAs to invest in Upside Avenue. His expertise in sales, marketing, and financial analysis allow him to streamline the sales process and aid in business development.

Thomas Parker leads Investor Relations for Upside Avenue. He ensures a smooth onboarding process for new clients into the REIT platform and assists those using self-directed IRAs to invest in Upside Avenue. His expertise in sales, marketing, and financial analysis allow him to streamline the sales process and aid in business development.