Tired of fielding questions about market volatility?

Offer your clients a stable alternative to the stock market

Our multifamily REIT offers your clients yield, appreciation, broad diversification, and low correlation to public securities.

The Upside of Multifamily REITs

Annual appreciation and quarterly distributions (or dividend reinvestments) are key features of our REIT.

Why select Upside Avenue over other REIT options?

MULTIFAMILY FIRST – We’re not tech companies dabbling in multifamily investing.

SPECIALIZATION – We’re focused on multifamily in high growth, high demand geographic areas

EXPERIENCE – We offer a combined 100+ years of experience backed by the Casoro Group.

PERFORMANCE – We offer solid historical performance.

SPECIALIZATION – We’re focused on multifamily in high growth, high demand geographic areas

EXPERIENCE – We offer a combined 100+ years of experience backed by the Casoro Group.

PERFORMANCE – We offer solid historical performance.

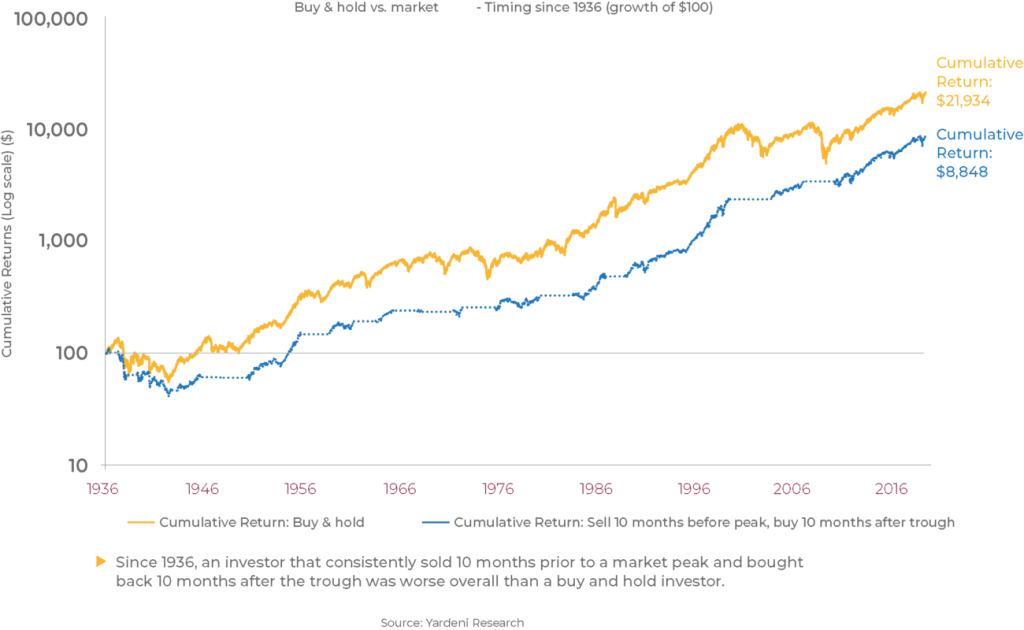

OFFER YOUR CLIENTS A LONG-TERM HOLD INVESTMENT TO INCREASE CUMULATIVE RETURNS.

Buy and hold investors consistently perform better than investors trying to time the market. Our REIT has a 1-year minimum holding period.

SHAREHOLDER REDEMPTION ALLOWS FOR NEAR-TERM LIQUIDITY AND FLEXIBILITY

Less than 1 year No redemption allowed

1-2 years 2% liquidity premium

2-3 years 1% liquidity premium

3+ years

No liquidity premium

Shareholder’s death or disability

No liquidity premium

Upside Avenue drives value for financial advisors

UPSIDE AVENUE DRIVES VALUE IN THREE DISTINCT WAYS:

- We offer a robust alternative investment vehicle that provides your clients with steady returns and diversification.

- We offer white glove services that include consistent reporting, transparency, and active communication.

- Opportunity to build a thought-leadership presence through invitation-only events.

Enter your information below to receive more information about Upside Avenue.

*Mandatory information