Investing for Cash Flow

Most millionaires share a common strategy, and it’s no secret – they focus on building multiple streams of income. 65% of millionaires have at least three income streams, and nearly a third of millionaires have five or more income streams. Generating regular consistent cash flow is the single best way to build wealth. Investing for […]

How to Protect Your Portfolio from the Effects of Coronavirus

The stock market just experienced its biggest drop since 2008 thanks to the reverberating effects of Coronavirus. How should investors respond? … The Centers for Disease Control (CDC) expects that the coronavirus (Covid-19) outbreak will continue spreading in the United States, with the World Health Organization officially naming the illness as a pandemic. This outbreak […]

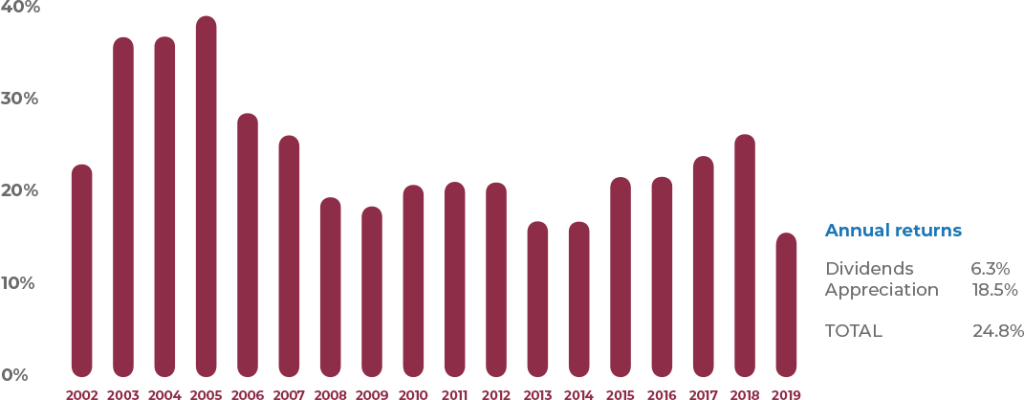

Why invest in a non-traded REIT?

Non-traded REITs offer certain buffers against stock market volatility By Thomas Parker With fears over a new recession, investors are looking for ways to stabilize their portfolios ahead of a downturn. More and more investors are allocating funds into income-producing real estate that isn’t correlated to stock market volatility. According to investment banking firm […]

What do Cap Rates tell you about a real estate investment property?

You can discover a property’s cap rate in a single simple formula. Upside Avenue CIO Todd Marney shares what a Cap Rate is, how it can help you make smart investment decisions, and helps you understand the different cap rates for different types of real estate. By B. Todd Marney If you’re new to […]

How the yield curve helps you plan for a recession

Is a recession imminent? Upside Avenue CEO Yuen Yung shares how understanding the U.S. Treasury yield curve can help you make sure your portfolio is ready for a downturn You’ve heard all of the tensions economists and analysts have over the inverted yield curve, but does that mean for your investments? In this post, […]

Connect with Upside Avenue at an Upcoming Event

Upside Avenue plays an active role in the real estate investment community by frequently attending and speaking at events. Our team will be at a number of conferences throughout the United States this quarter and would love to connect. Contact us today to meet with Tom, Laura or Yuen at one of our upcoming events. […]

The No. 1 Way Technology Improves Real Estate Investing

Investing in real estate is easier than ever thanks to advances in technology If you want to invest like a millionaire, you’ll need to invest in real estate. But if you’re new to investing, and pause at the idea of putting your hard-earned money to work in the confusing world of real estate investing, there’s […]

Five Reasons to Recession-Proof your Real Estate Investment in the Sunbelt Region

Why multifamily investing in the south can help you weather a recession on the upside You’ll find real estate investment opportunities throughout the United States, but which ones are more likely to yield returns in the face of a recession? Recent headlines tout the impressive boom in new multifamily construction in Texas, a juggernaut of […]

Why you should diversify your portfolio

Stock market volatility can put a lot of investors on edge. Learn why diversification can help you hedge against the inherent exposure to risk you get with traditional investing. Diversification is the safest hedge against increasing volatility in the stock market. Even when the stock market is performing strong, diversifying your portfolio across various types […]

What Is the Simplest Way to Build Wealth with Real Estate?

Real Estate Investing is the core to building wealth – but is it easy to do? Real estate investing is a powerful wealth building tool. Since the beginning of time, ownership of land and property is what elevated a person into a position that provided security and opportunities not available to the average person. How […]