Why invest in a non-traded REIT?

Non-traded REITs offer certain buffers against stock market volatility By Thomas Parker With fears over a new recession, investors are looking for ways to stabilize their portfolios ahead of a downturn. More and more investors are allocating funds into income-producing real estate that isn’t correlated to stock market volatility. According to investment banking firm […]

What do Cap Rates tell you about a real estate investment property?

You can discover a property’s cap rate in a single simple formula. Upside Avenue CIO Todd Marney shares what a Cap Rate is, how it can help you make smart investment decisions, and helps you understand the different cap rates for different types of real estate. By B. Todd Marney If you’re new to […]

Connect with Upside Avenue at an Upcoming Event

Upside Avenue plays an active role in the real estate investment community by frequently attending and speaking at events. Our team will be at a number of conferences throughout the United States this quarter and would love to connect. Contact us today to meet with Tom, Laura or Yuen at one of our upcoming events. […]

Why you should diversify your portfolio

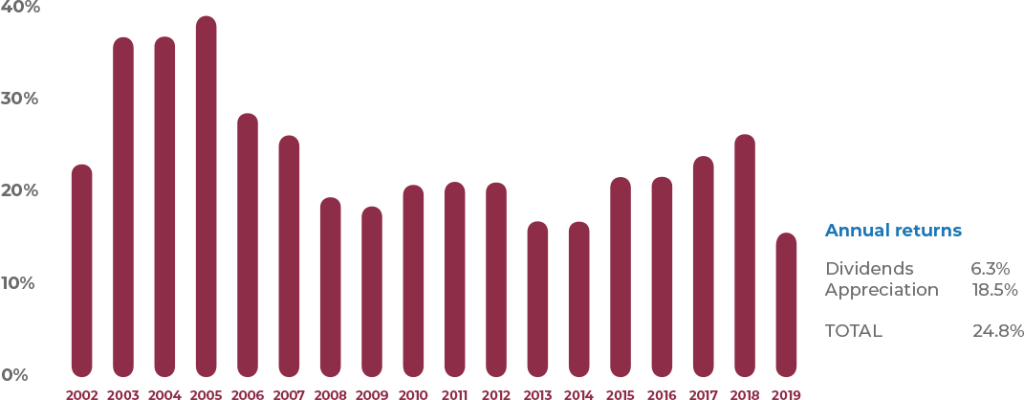

Stock market volatility can put a lot of investors on edge. Learn why diversification can help you hedge against the inherent exposure to risk you get with traditional investing. Diversification is the safest hedge against increasing volatility in the stock market. Even when the stock market is performing strong, diversifying your portfolio across various types […]