Each time the end of a financial quarter nears, you anticipate getting those dividend checks from your investments. As tempting as it may be to splurge on a new gadget or weekend getaway to the beach, we want you to consider the benefits of reinvesting your distributions.

A DRIP, or Distribution Reinvestment Plan, is a way for you to buy new shares in an investment so your core contribution has the potential to grow over the life of the investment.

Let’s say, in a totally theoretical example, you invested $100 into a company for 10 shares. The value of those shares is projected to increase 10 percent over the life of the investment period. So, your quarterly distribution check would be 10 percent of $100, or $10.

The company gives you the option of direct-depositing that $10 into your checking account, where you’ll be able to turn around and buy a case of Topo Chico mineral water and a bag of M&Ms.

Or, the company offers to reinvest that $10 through a DRIP, giving you the opportunity to own 11 shares in the company instead of 10. With your core investment now at 11 shares, when the next distribution period rolls around, again with theoretical earnings of 10 percent, you will have earned $10.10. If the earning trend continues, and you always reinvest through the DRIP, your earnings trajectory will be higher than if you left your core investment alone.

Granted, this theoretical sample uses absurd numbers, but you get the idea. The more you reinvest, the higher your potential to earn, depending on the performance of your investment.

Keep in mind, investing is always a risk, and no guarantees are ever made on the performance of an investment. Any company worth their salt, like Upside Avenue, will have a thorough due diligence process and total transparency with investors on the types of assets they are purchasing.

Here are five more reasons reinvesting through a DRIP may be a good choice for your dividends, courtesy of Investopedia:

- DRIPS are typically commission-free investments because no broker is needed to facilitate the trade. For small investors, this is appealing because you don’t have to front a large amount of money to make the typical brokerage fee small enough in proportion to the investment amount.

- Some DRIPs offer optional cash purchase of additional shares from the company, usually at a 1-10% discount, again with no fees attached.

- DRIPs are flexible. You can invest a lot, or a little, however much you can afford. Some DRIPS allow investors to contribute as little as $10 or as much as $500,000 at one time. At Upside Avenue, we take the full disbursement amount and buy the maximum number of shares possible, at $10 per share.

- DRIPs often use dollar-cost averaging (averaging out the price at which you buy shares as the price moves up or down over a period of time), which means you never buy shares at their peak or at their lowest point.

- Some DRIPs offer stocks at a discount from the spot price, or immediate value of the share. Discounts often range from 1-10 percent. Because these discounts are coupled with the lack of commission fees, DRIP shares are often considerably lower than if you purchased shares outside of a DRIP.

So, can you invest in a DRIP whenever you want? Companies usually have a specified window in which they’ll allow you to reinvest your distribution through a DRIP. Check with your investment plan and investor communications to see when you have the opportunity to reinvest your dividends.

Upside Avenue allows investment contributions of as little as $2,000 and offers a DRIP or cash disbursements for dividend earnings. By enrolling in the DRIP plan, you are able to benefit from the power of compounding by using your quarterly distributions to automatically buy more shares of the Upside Avenue REIT. Our fund administrator will then use your distributions to buy more shares (our current per value is $10), allowing your portfolio to continue to grow over time.

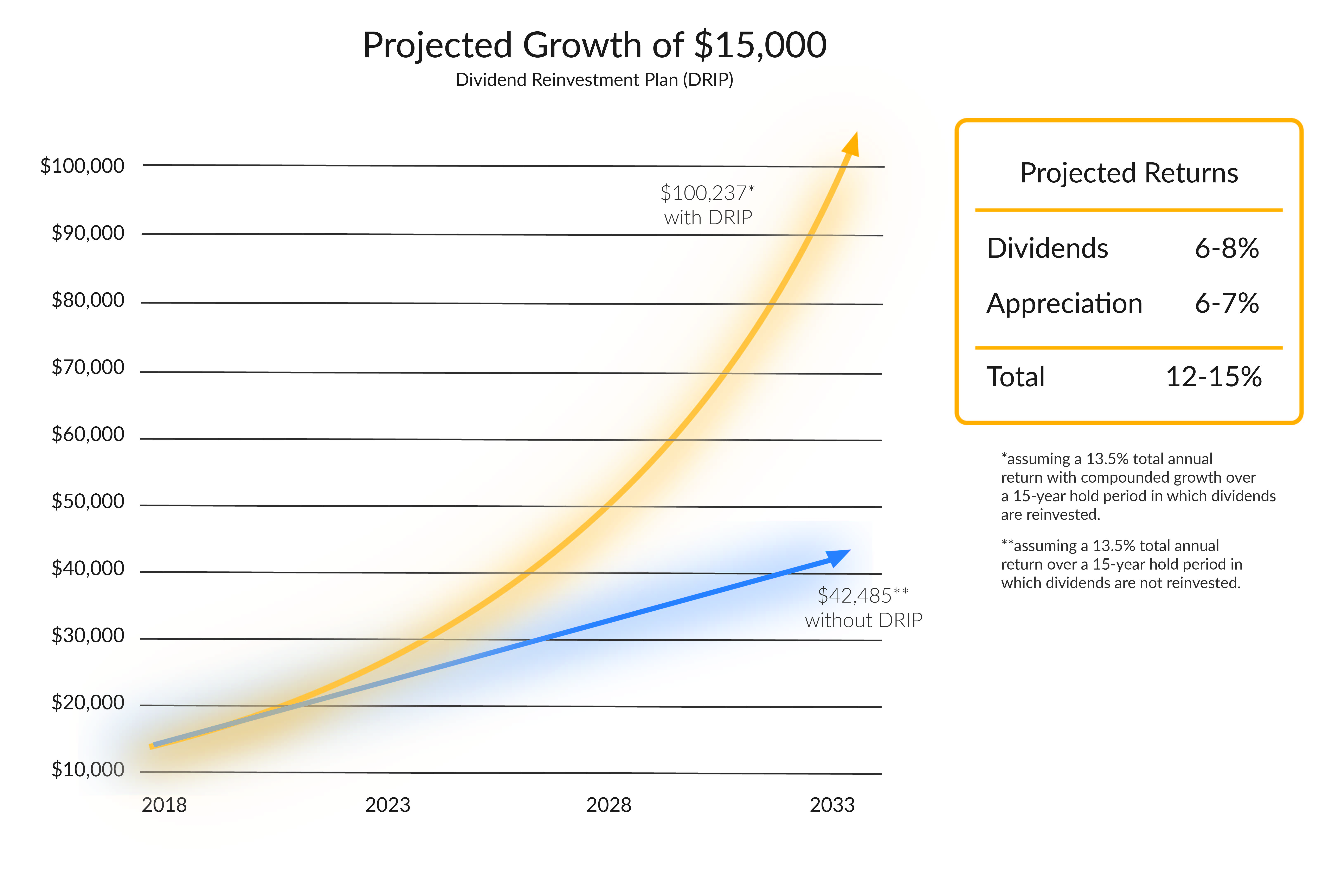

The chart below reflects the projected growth of a $15,000 investment that is enrolled in the Upside Avenue DRIP (assuming a 13.5% total annual compounded growth rate) over a 15 year hold horizon, compared with a $15,000 investment with no additional DRIP:

Learn more about the simplicity of investing with the Upside Avenue REIT, go to UpsideAvenue.com or give us a call at 512-492-8882.