How to Protect Your Portfolio from the Effects of Coronavirus

The stock market just experienced its biggest drop since 2008 thanks to the reverberating effects of Coronavirus. How should investors respond? … The Centers for Disease Control (CDC) expects that the coronavirus (Covid-19) outbreak will continue spreading in the United States, with the World Health Organization officially naming the illness as a pandemic. This outbreak […]

Expert Insights: Can Risk be Easily Quantified?

Wall Street has brought forth various ways to give the appearance that the future action of the market is somehow rational or predictable. The Efficient Market Theory (EMT), Capital Asset Pricing Model (CAPM), Value at Risk (VaR) are such examples. They sound very knowing and lend an air of expertise to markets and investing. They […]

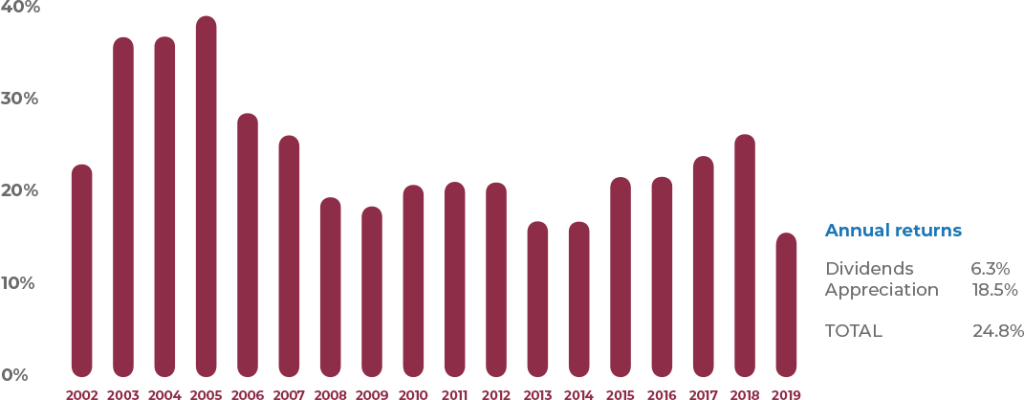

Why invest in a non-traded REIT?

Non-traded REITs offer certain buffers against stock market volatility By Thomas Parker With fears over a new recession, investors are looking for ways to stabilize their portfolios ahead of a downturn. More and more investors are allocating funds into income-producing real estate that isn’t correlated to stock market volatility. According to investment banking firm […]

How the yield curve helps you plan for a recession

Is a recession imminent? Upside Avenue CEO Yuen Yung shares how understanding the U.S. Treasury yield curve can help you make sure your portfolio is ready for a downturn You’ve heard all of the tensions economists and analysts have over the inverted yield curve, but does that mean for your investments? In this post, […]

Why you should diversify your portfolio

Stock market volatility can put a lot of investors on edge. Learn why diversification can help you hedge against the inherent exposure to risk you get with traditional investing. Diversification is the safest hedge against increasing volatility in the stock market. Even when the stock market is performing strong, diversifying your portfolio across various types […]