Protecting your investment portfolio during a recession is an important part of finding long-term financial success. Over the life of your investments, the economy will fluctuate both positively and negatively multiple times. Protecting yourself from the downturns is crucial. With that in mind, there are some investment opportunities that are better than others at hedging your portfolio. One such example of these wise investments are real estate investment trusts, also referred to as REITs. Discover more about what makes REITs good investment vehicles, even when the economy is struggling.

Predictable Cashflow

The point of any investment is to make as much money as possible given the appropriate risk tolerance of an individual. While the stock market and many other types of investments do offer the potential for impressive dividends, multifamily real estate tends to provide impressive returns while mitigating risk due to the fundamental need for housing. While the value of stock in a particular company may only go up by a few cents per share in a given year, REITs also offer higher dividends than stock investments and are a great inflation hedge. This is especially good news for older investors who have a shorter investment horizon but seek strong risk adjusted returns.

Less Volatile

Most investors like to protect themselves against market volatility. While there are always arguments to be made about taking risks to increase returns, many investors prefer the safety associated with investing in less volatile options. REITs are not as volatile as other equity investment vehicles, thanks in large part to the strategy that investors approach them with. REIT investments, especially those that are non-traded, involve holding onto the investments with a long-term outlook. This makes them a less volatile option than many other types of equity investments that are simply focused on quarterly returns.

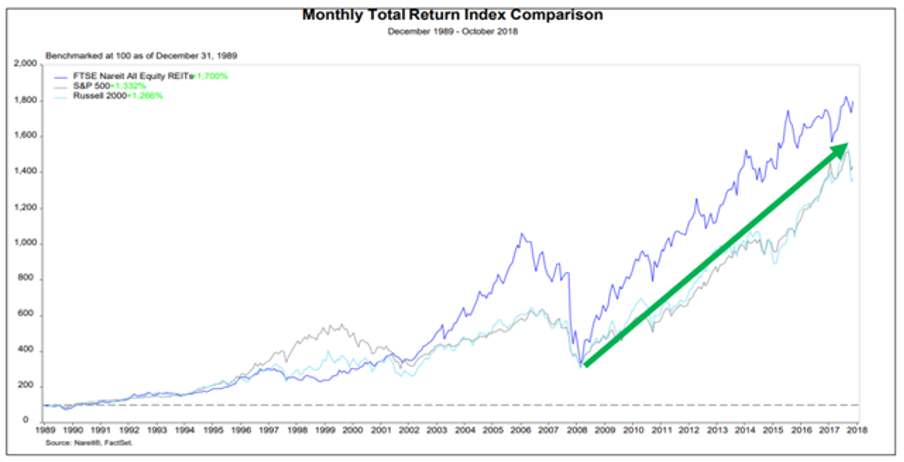

REITs Outperform Stocks During Recessions

The stock market is extremely volatile during recessions. Publicly traded stocks rely heavily on the performance of the companies that are being traded in order to succeed. During a recession, those companies struggle, and their stock value drops. According to Cohen & Steers, a company that boasts $88 billion in assets, including $56 billion in real estate, real estate provides superior returns following recessionary periods, which is a great reason to add REITs to your portfolio.

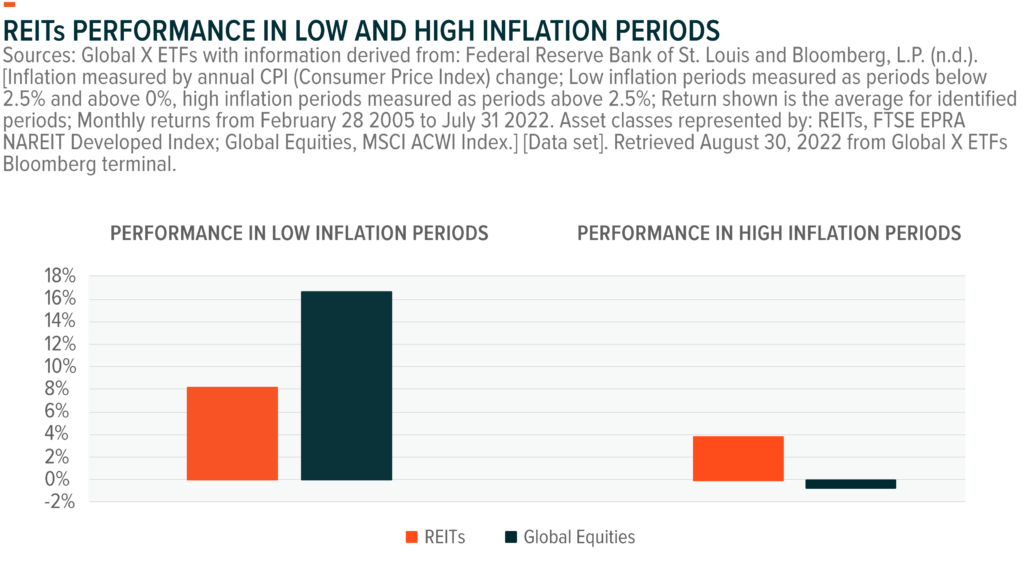

REITs Are Stable During High Inflation

Periods of high inflation can wreak havoc on the economy. However, REITs remain stable, even in the face of high inflation rates. The federal government is currently taking extraordinary measures with interest rate increases to reduce inflation. Rising interest rates cause significant increases to the cost of owning a single-family home through higher mortgage rates, and associated credit needed to improve and maintain a home. That makes rental properties, which non-traded REITs often include, a great investment option. When mortgage rates are high, the demand for rental property increases.

REITs Are Stable During High Inflation

Periods of high inflation can wreak havoc on the economy. However, REITs remain stable, even in the face of high inflation rates. The federal government is currently taking extraordinary measures with interest rate increases to reduce inflation. Rising interest rates cause significant increases to the cost of owning a single-family home through higher mortgage rates, and associated credit needed to improve and maintain a home. That makes rental properties, which non-traded REITs often include, a great investment option. When mortgage rates are high, the demand for rental property increases.

About Upside Avenue

For decades, the ultra-wealthy and financial institutions have been putting their money to work in real estate—now with Upside Avenue, you can too. We provide access to a professionally managed, diversified portfolio of income-producing multifamily real estate for as little as $2,000. Learn more about the Upside Avenue Multifamily REIT with targeted returns of 10-15% IRR.

Disclaimer

The information contained in this video or this website is provided for informational purposes only and is not intended to substitute for proper due diligence or professional financial, legal or tax advice. This is not a solicitation to buy or sell any security or to make any financial decisions. All investments involve risk. Please review our Offering Statement before considering an investment, including the section captioned Risks of Investing. Any advertisers or sponsors used are for informational purposes only and are not endorsements of any product or service.