The stock market had its best start this year in more than three decades. On January 9, 2018, the S&P 500 hit a fresh record all-time high of $2,751.29 and logged its strongest showing since 1987 — the same year as the ‘Black Monday’ October financial crash.

While some investors are celebrating, others remain cautious due to a widespread belief that the stock market is overvalued. As of the writing of this piece, the last 3 consecutive trading sessions had stocks slumping, and giving up more than 4% on the NASDAQ and less than 2% on the S&P 500. This has led to multiple predictions of a stock market correction, with analysts predicting it to happen as early as November of 2018.

With increased uncertainty comes a greater need for portfolio diversification, and yet many are ignoring the signs. Diversifying into assets which are not correlated to the stock market, like non-traded, private market real estate investing, could help to inoculate a portfolio against upcoming corrections and volatility within the stock market.

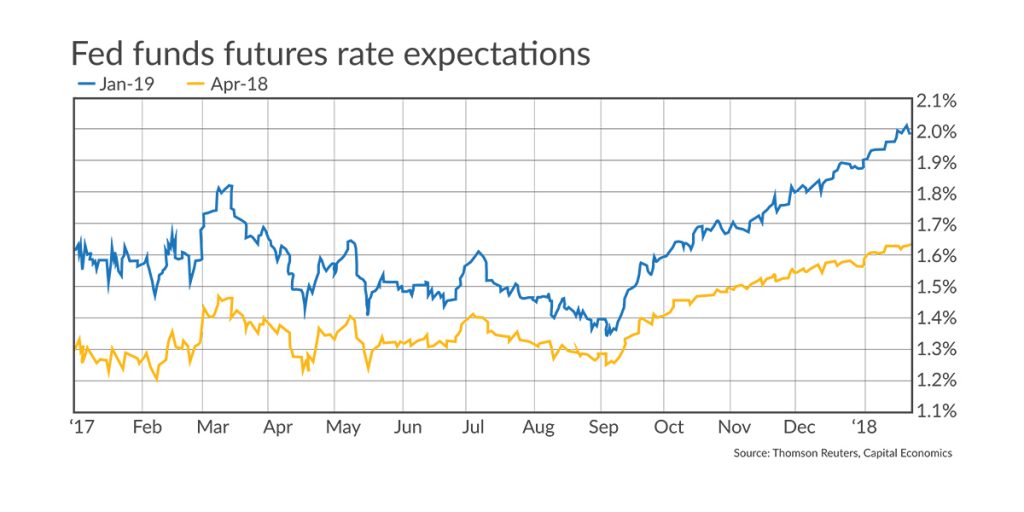

FED Funds Rate

The Federal funds rate, or the rate banks are charged for borrowing money from the Federal Reserve, is used to control inflation. For years following the financial collapse of 2008, the Fed Funds rate lingered near 0 percent to prompt business spending and expansion.

In response to margin pressures, the Federal Reserve with raise rates in an effort to shore up its balance sheet. Basically, by increasing the fed funds rate, the Federal Reserve attempts to shrink the supply of money available or purchasing or doing things by making money more expensive for businesses obtain.

While the increases in the fed funds rate does not directly affect the stock market, it does make bank borrowing more expensive, and has a ripple effect on the stock market. This is stifling for a business who is looking to expand or grow, because the fed funds rate directly influences the prime rate, the rate which banks charge their most credit-worthy customers. The prime rate follows the fed funds rate, and is the foundation for mortgage loan rates, credit card annual percentage rates (APRs) and other consumer/business loans. And ultimately, when people are charged more to borrow from banks, they spend less, which in-turn hurts business revenues and earnings.

Rising Interest Rate Environments

Increases in the fed funds rate have already happened. At the end of September 2018, the fed funds rate was increased by .25 basis points to a range of 2-2.25 percent. The Federal Open Market Committee estimates one more rate hike before the end of 2018, and three in 2019.

As previously mentioned, when fed funds rates increase, earnings can be affected, and companies appear to be less profitable or risky. This affects price-to-earnings ratios, major market indices like the Down Jones Industrial Average or S&P 500, and eventually the stock price of a company will usually take a hit. Finally, making the stock owner’s experience more volatile and less desirable.

Price-to-Earnings Ratios

“The most broadly overvalued moment in market history.”

-John Hussman

The widespread belief that stocks have grown too expensive is prompting calls for a market correction from well-known analysts.

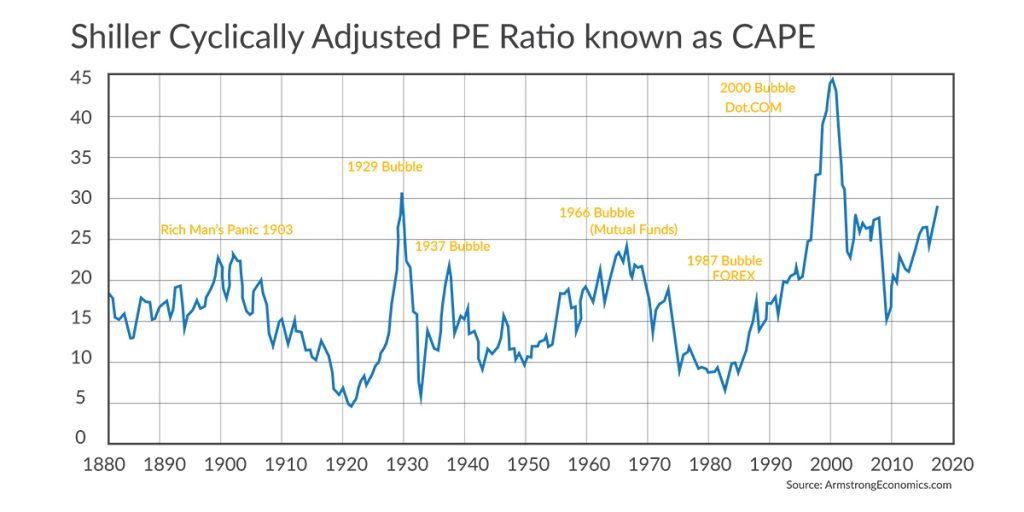

The price/earnings ratio is the ratio of a company’s stock price relative to the company’s earnings per share. Indicating the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. Large disparities in this ratio can indicate that certain stocks are overvalued relative to the earnings that they generate, and are usually an indicator of a market “bubble.”

John Hussman, the stock market analyst and mutual fund owner who predicted the bursting of the technology bubble in 2000, stated in March 2017 that the risks of investing in the stock market now are more pervasive and potentially harmful than they were in past economies like that of 2000 and 2008. Hussman stated:

“In the past, problems were relegated to a relatively small group of super-expensive stocks, including technology, and later finance and housing companies, respectively, that drove the average valuation of the stock market much higher than normal

…Today, it’s the median, not the mean S&P 500 valuation that sits well above the peaks seen in 2000 and 2007, indicating that there are far more companies these days that’s shares trade at much higher-than-normal valuations.”

The figure bellows illustrates that while the Shiller cyclically adjusted price-to-earnings ratio is not as predominant as the 2000 tech bubble, we are on-par with black Tuesday of 1929.

Imminent Market Correction

A market correction refers to a price decline of at least 10% of any security or market index following an upswing in market prices.

Komal Sri-Kumar, whose economic consultancy advises multinational firms and sovereign wealth funds, believes a double-digit stock market reckoning is coming in the form of a bear market where prices fall and pessimism in the markets persists. Sri-Kumar, who echoed Alan Greenspan’s “irrational exuberance” speech noted:

“You can have this bubble get bigger. But the question is how big does it get? Irrationality can last a long time.

… The true downside [now] is for the equities to continue to rise and to have a much sharper fall at some point in time.”

…A decline of 5 percent, or even 10 percent, is nothing. You have to talk in terms of a 15 percent to 20 percent decline. But the question is when does it happen? The answer is the later it happens the bigger the magnitude of the decline.”

Conclusion

Only time will tell what will truly happen with the markets in 2019, but one thing is for certain…It’s not if, but when the bear market will wake from hibernation, and dominate the capital markets. This brings a timely case for a flight to diversification in the form of real estate investing using alternatives like non-traded, non-correlated, private market real estate. These types of assets can help investors achieve a smoother investment experience, allowing them to stay the course for long-term out performance.

Yuen Yung, CMFC and CFP® serves as CEO of Upside Avenue, an income-focused REIT investing in apartments, senior housing and student housing which is open to all investors throughout the globe. Yuen is a seasoned real estate and financial professional who spent over a decade in the investment management industry.