Currently, the stock market is at an all-time high, with little doubt in leading economists’ minds that the end of the rally is near. The anticipation of a probable decline has many investors and investment advisors in search of investment products which they feel will remain strong for the years to come.

While the stock market and overall economy may go up-and-down, at Upside Avenue, we make our investment decisions based upon long-term economic data as well as local market trends.

We focus on three asset classes we feel have the wind at their backs to go the extra mile; multifamily, senior living, and student housing in select markets across the U.S. What the data is saying about the future of the multi-housing market may surprise you. For example, a 2018 report by CBRE, the world’s largest commercial real estate firm, reported that multifamily real estate had average returns of 9.75% and a total volatility of 7.75% over the last 25 years.

Multifamily

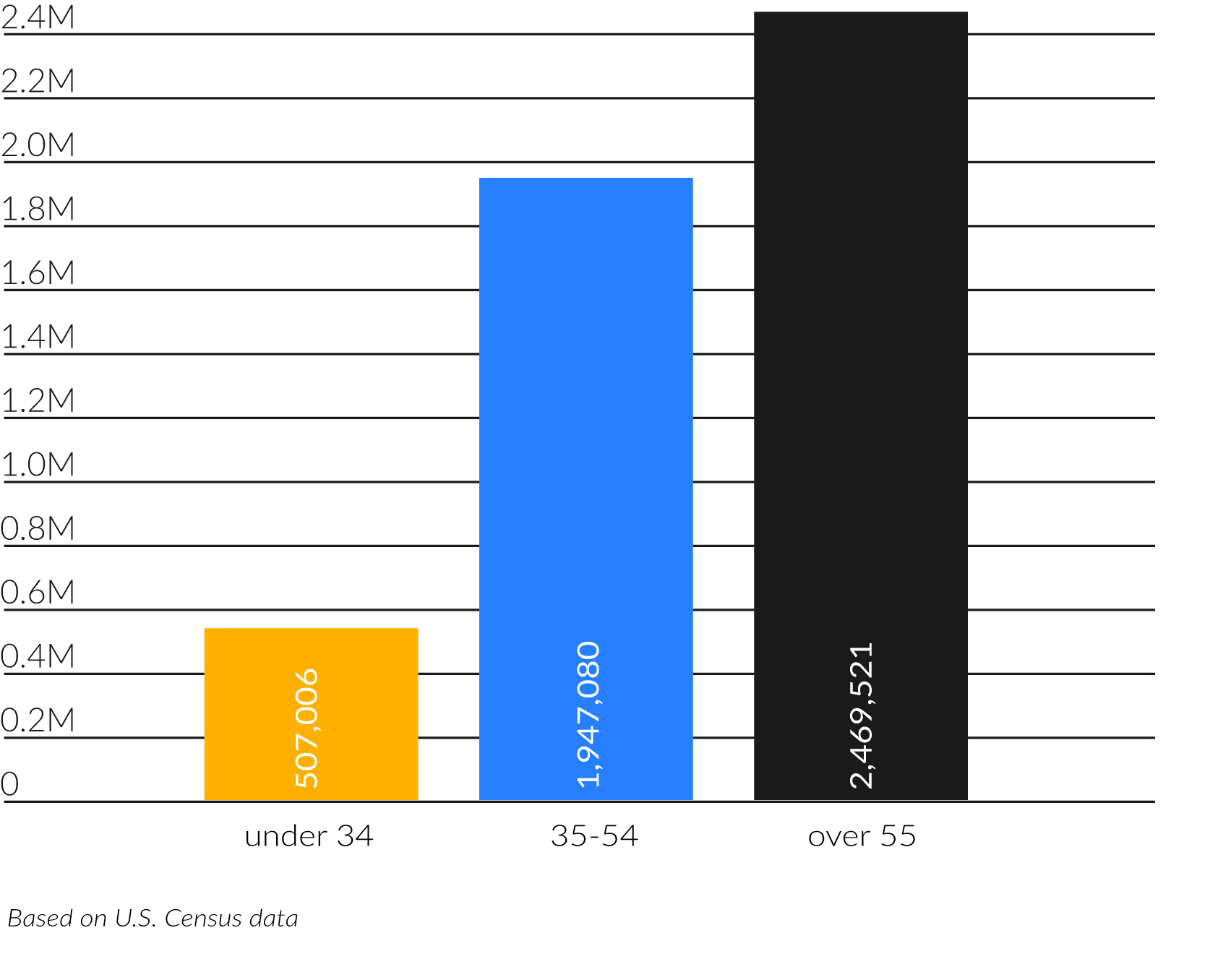

The renter population is expected to grow significantly from now through 2041. Over 4.6 million new rental units (350,000 per year) are needed by 2030 to meet projected demand. While average deliveries over the last four years were 244,000. The growth in the renter population is largely attributable to Millennial’s who are not ready to commit to home ownership. However, an underlying theme reported by the 2015 census report is that baby boomers are becoming the fastest growing renter demographic in the country.

More than 5 million Baby Boomers are expected to rent their next residence by 2020. Many sources report Baby Boomers opting for upscale, amenity-rich, multifamily rentals in urban neighborhoods, which promise flexibility, cultural vibrancy, and a newfound sense of community in apartment homes.

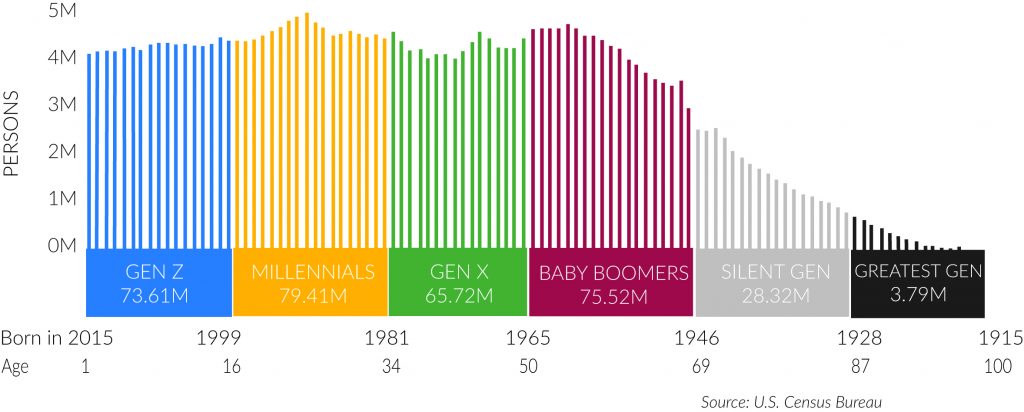

Net Increases in U.S. Renters by Age Group

Additionally, the Generation Z population, with just 1.9 million less people than the massive Baby Boomers, have just begun to enter the rental and student housing market. This massive influx of new renters will only continue to increase the demand within multifamily markets.

While Millennial’s may eventually want to settle down and buy a home, the sad fact is that they average over $42,000 in both credit card and student load debt, and are racking up debt faster than any other generation. These factors, combined with their love for urban living, may keep this generation renting far beyond what has been normal for other cohorts.

Total Population by Age and Generation

Senior Living

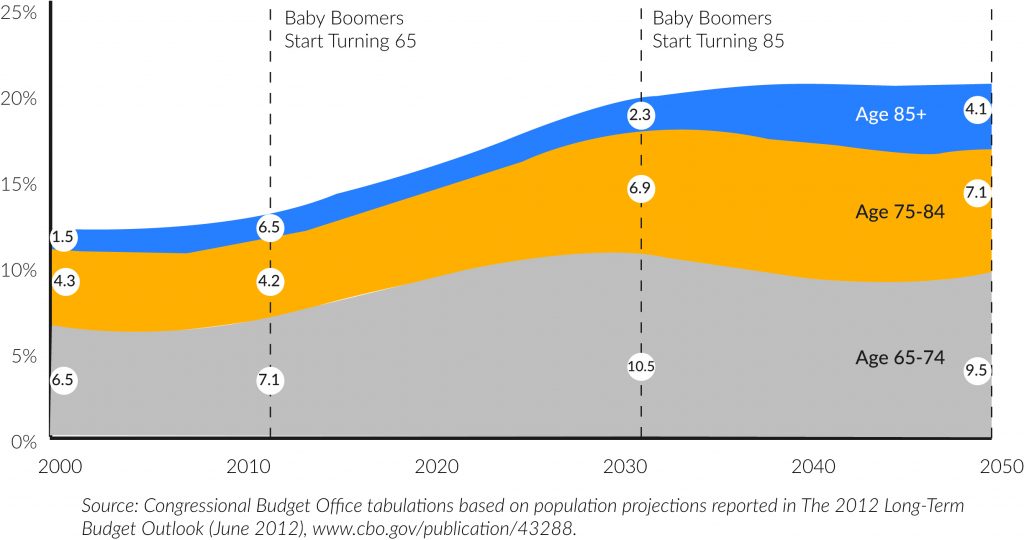

While some of the Baby Boomer population is moving into multifamily properties, an even larger number of older Boomers, or those with failing health, are opting for adult-active and senior living communities. The 65+ population is expanding in conjunction with the improved longevity of the Boomers’ population. This is only the beginning: by 2030, approximately 21% of the population, or 74 million people, will be past retirement age.

Senior living is expected to be the second most active segment of the multi-housing market over the next three years.

Elderly Adults as a Share of the U.S. Population (2000-2050)

Student Housing

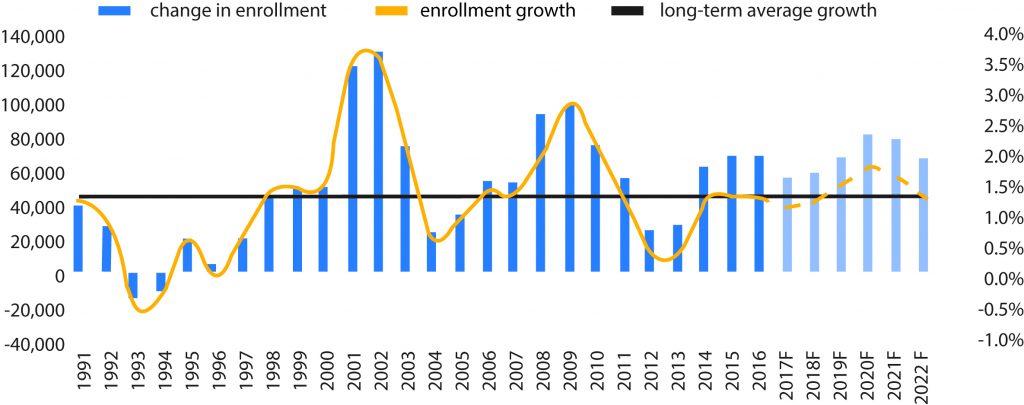

One of the most promising demographic trends in the student housing sector is that 70% of college-aged students are choosing to enroll in college courses, as reported by the Bureau of Labor and Statistics. While there was a dip in enrollment between the 2016 and 2017 school years, there are steady increases in enrollment projected through 2022.

University Enrollment Growth (1991-2022)

In addition to these projections, by 2026 there will be 22.6 million people pursuing a post-secondary degree in the U.S., up from 20.4 million in 2017 and just 6.6 million in 1990, according to the National Center for Education Statistics.

With the 2018 ValuePenguin survey showing a 302% increase in tuition costs, many of these current students are rapidly racking up debt for educational costs which may keep them in the rental markets for years to come.

Finally, many sources are predicting the continued increase in rents in many areas due to the demand for new, nicely-furnished alternatives to the run-down college dorms and off-campus homes. All of these trends point to steady, but strong, growth in the student housing market for the foreseeable future.

Conclusion

In conclusion, the economy may go through ups and downs, however, there is no debating the massive amounts of renters coming and staying online in the upcoming decade. Baby Boomers are giving up their suburban homes in search of lower maintenance life-styles. Millennial’s are choosing urban lifestyles, and are often too in-debt to afford to buy a home. Finally, we are just seeing the massive Generation Z coming of renting age.

While not all areas of the country will be spared when the next downturn does occur, we feel there are some areas which are likely to fair better than others.

When thinking about asset selection, we are looking at primarily sun-belt markets, which can still increase in overall value—as opposed to the coasts, which we believe are already overpriced. In addition to huge influxes of baby boomers moving to these sunnier states, we have seen the last decade bring job growth and diversification to the employment base for many of the areas we look for assets within.

Additionally, we tend to invest in B and C class assets, which includes buildings that are 15-40 years old, not the brand-new class A buildings which tend to fair worse in recessionary cycles.

At the end of the day, we tend to be more conservative. At Upside Avenue, we have a long track record of success within the multifamily real estate market, producing an average return of over 33%, throughout our 16 years, investing over $1.2 billion within the multifamily market. While the seas may be rough we feel the data speaks for itself where the multi-housing markets are concerned.