Why investing in a Real Estate Investment Trust (REIT) hedges against market fluctuations

Real Estate investing has been one of the top wealth-building mechanisms since the dawn of time. But with recent headlines warning of downturns, people may be wondering if it’s still a smart investment choice in the current climate. That’s where a REIT, or Real Estate Investment Trust, comes in.

A REIT is dedicated to purchasing different types of real estate and is required by law to disburse 90% of its profits. Upside Avenue is a private market REIT, which means it is not listed on the stock exchange.

The Advantages of REIT investing

Private market real estate has a lot of advantages. They do not have to pay all of the fees that a public company requires, nor are their prices inflated or depressed based on the performance of the stock market. This boils down to greater cash flow and a stronger upside for investors.

How the Upside Avenue REIT works

At Upside Avenue, we invest in multifamily communities. These range from apartments to student housing, to senior living facilities. We invest in the best markets with the best growth prospects throughout the United States. This provides a cushion against market volatility as the demand for multifamily housing consistently remains high.

How you Earn an Upside

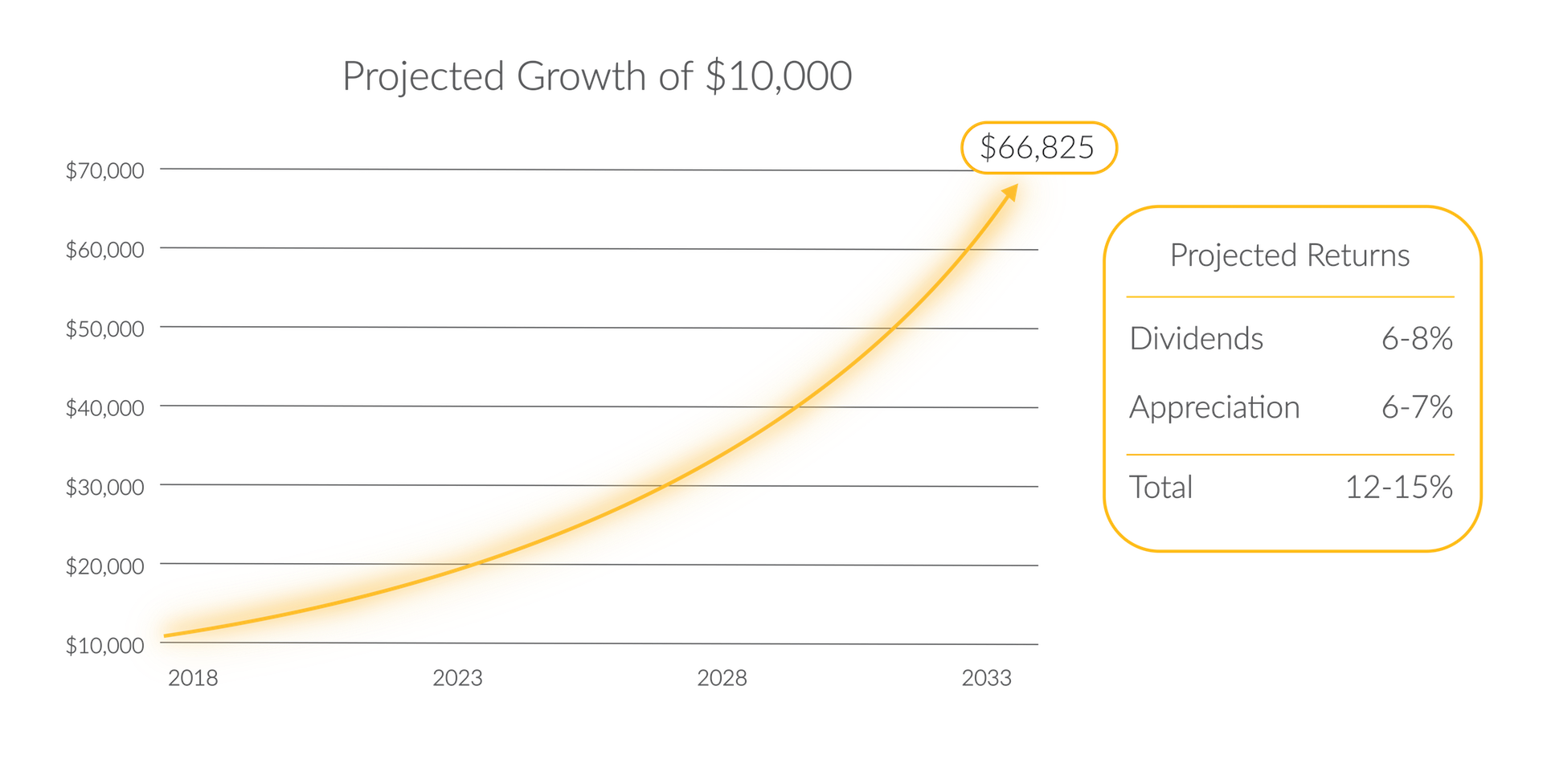

Investors with Upside Avenue receive a return on their investments from quarterly dividends and from appreciation in the value of shares in the REIT. The returns come from the individual real estate assets in the portfolio via interest and rental income collected, as well as appreciation in the value and sale of portfolio properties. Shareholders receive their pro-rata portion of any dividends that are paid out. We anticipate annual returns of 12-15%

This is an exciting time to invest in multifamily real estate and we invite you to join us on the Upside!

Invest now for as little as $2,000 in our expertly-managed REIT.